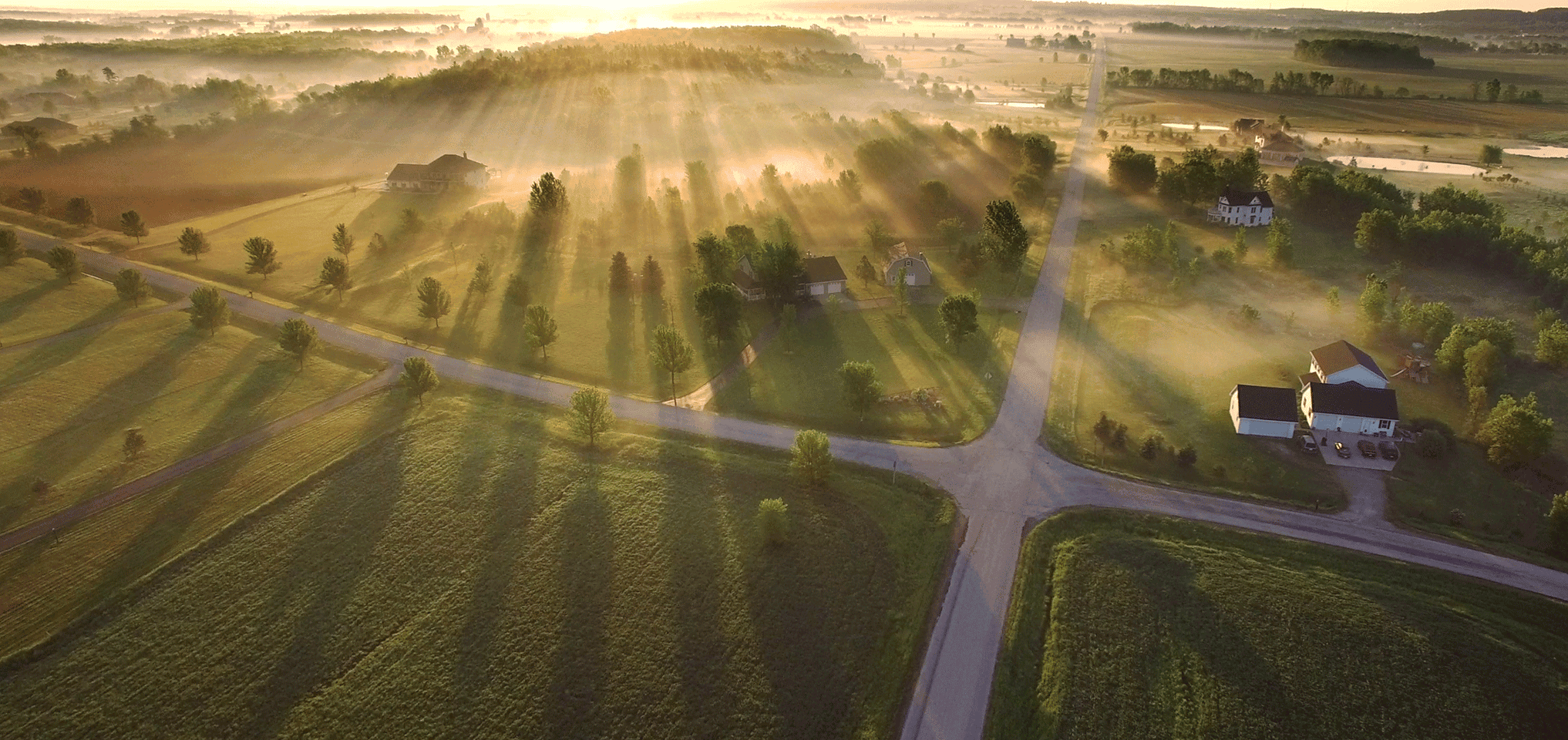

USDA loans are designed for eligible homebuyers with low to moderate income and are located in rural areas, as deemed by the United States Department of Agriculture (USDA). Just like VA (Veteran Administration) loans, USDA loans are government backed and offer great benefits and options to those who are unable to meet requirements and secure conventional loan options offered.