Prevent fraud and monitor usage by setting up push notification alerts easily from the mobile banking app. React to real-time activity and immediately turn your debit or credit card on and off. Changes in Card Controls take place immediately so you can stay safe and protected from unwanted use.

Card Controls Help Keep You Safe

- Turn your debit or credit card on and off

- Restrict where your card can be used by geographic region, merchant or transaction type

- Set up spending limits

- Block international transactions

- Disable online shopping purchases

- and more...

Need to stay on budget?

You can limit how much you can spend within your card’s approved transaction limits. Stay in control of your spending and adjust anytime.

Quick Guide for Using Card Controls

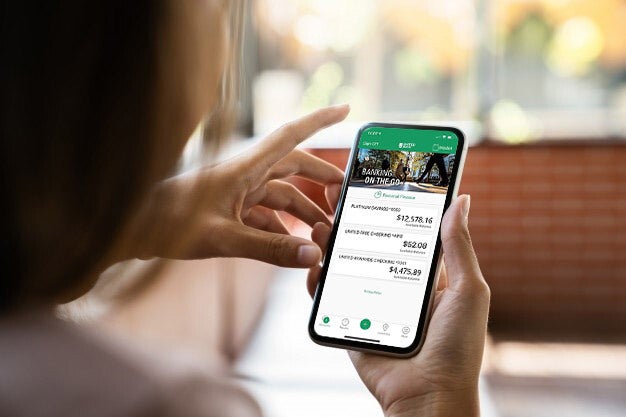

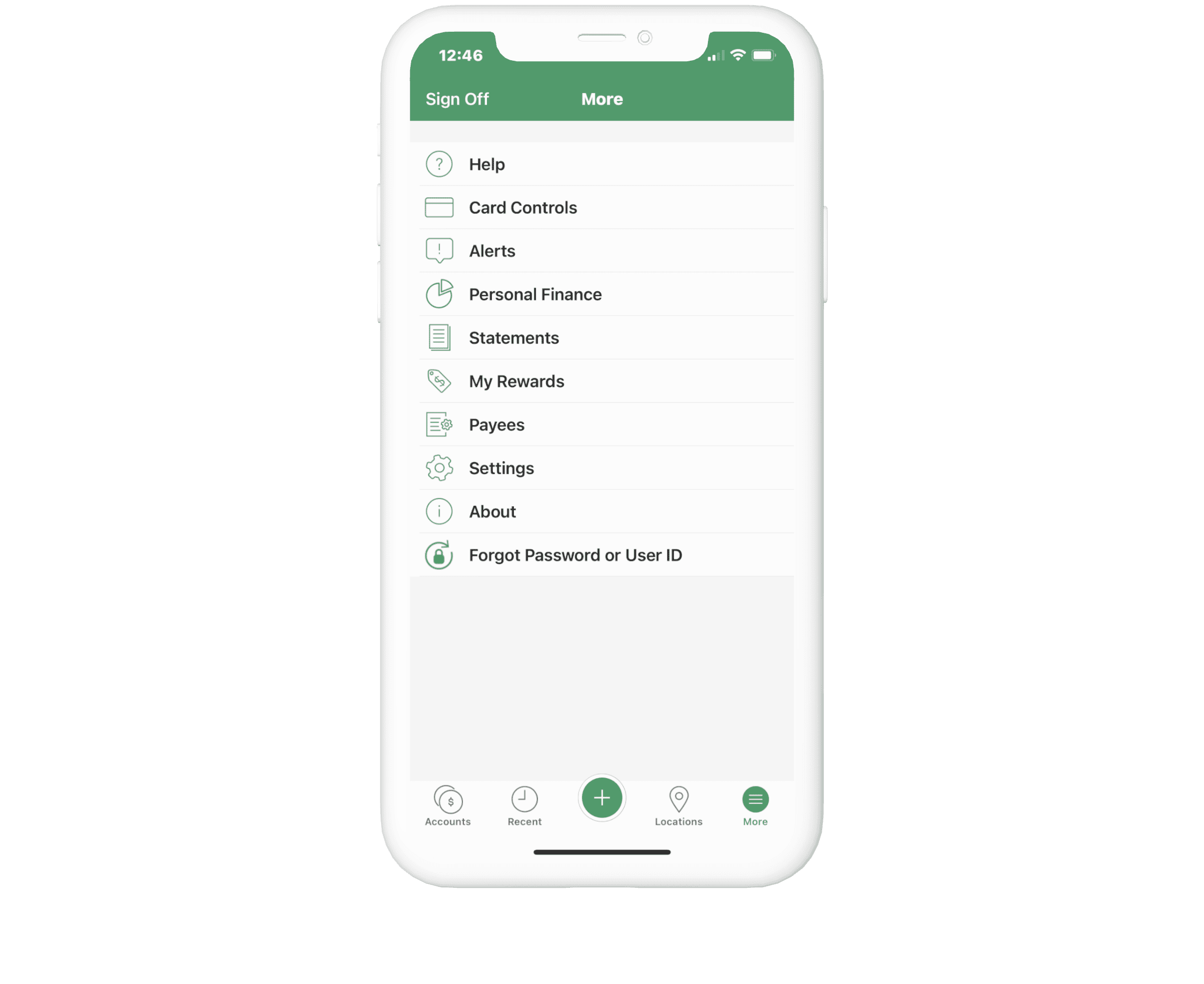

Card Controls is easy to find within your Bank With United Mobile App. After logging in, click the "+" at the bottom of your screen to find the More menu. You can access Card Controls from the menu, directly under Help. If you do not see Card Controls in your list of options, please update to the latest version of the United Bank Mobile App.

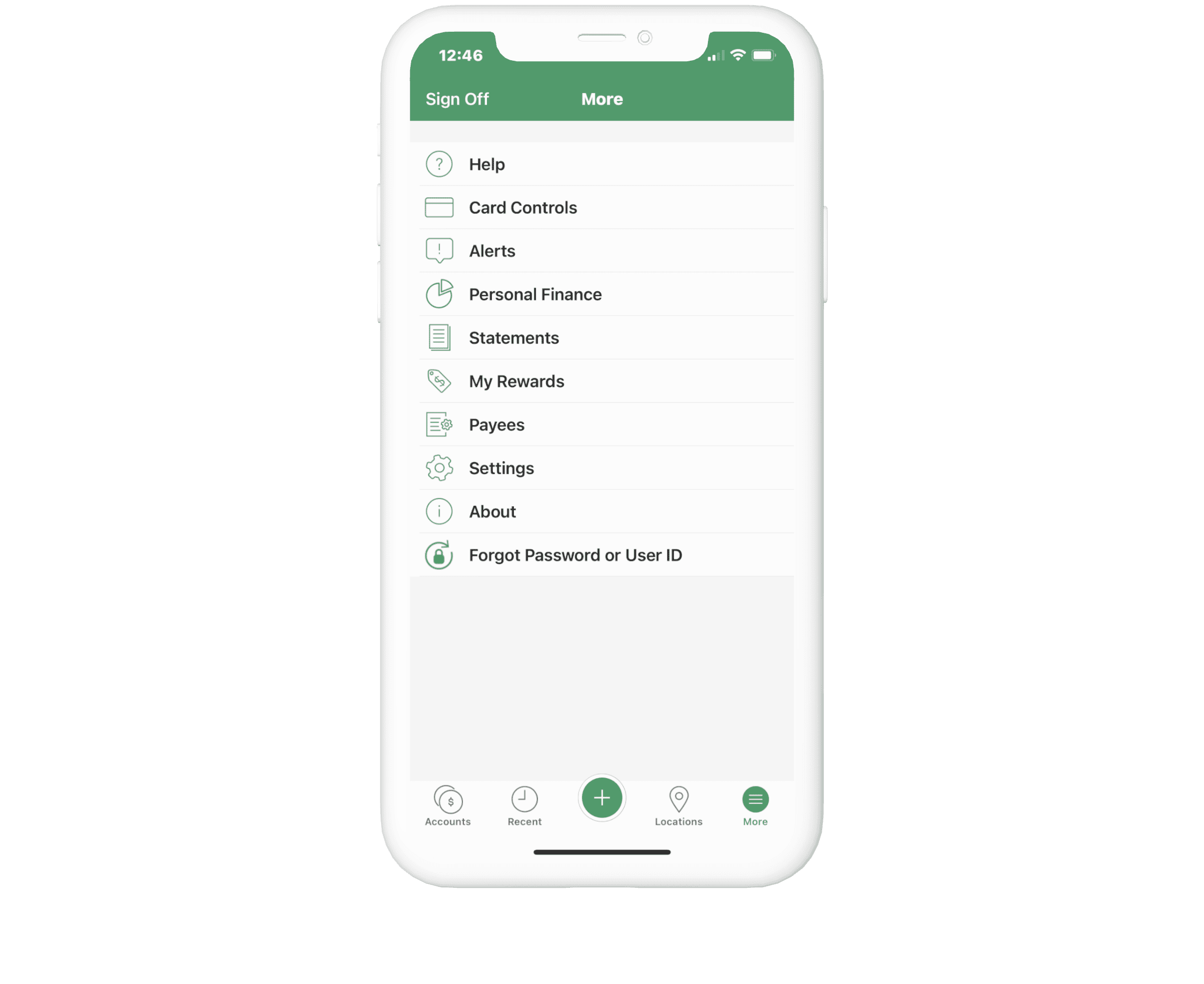

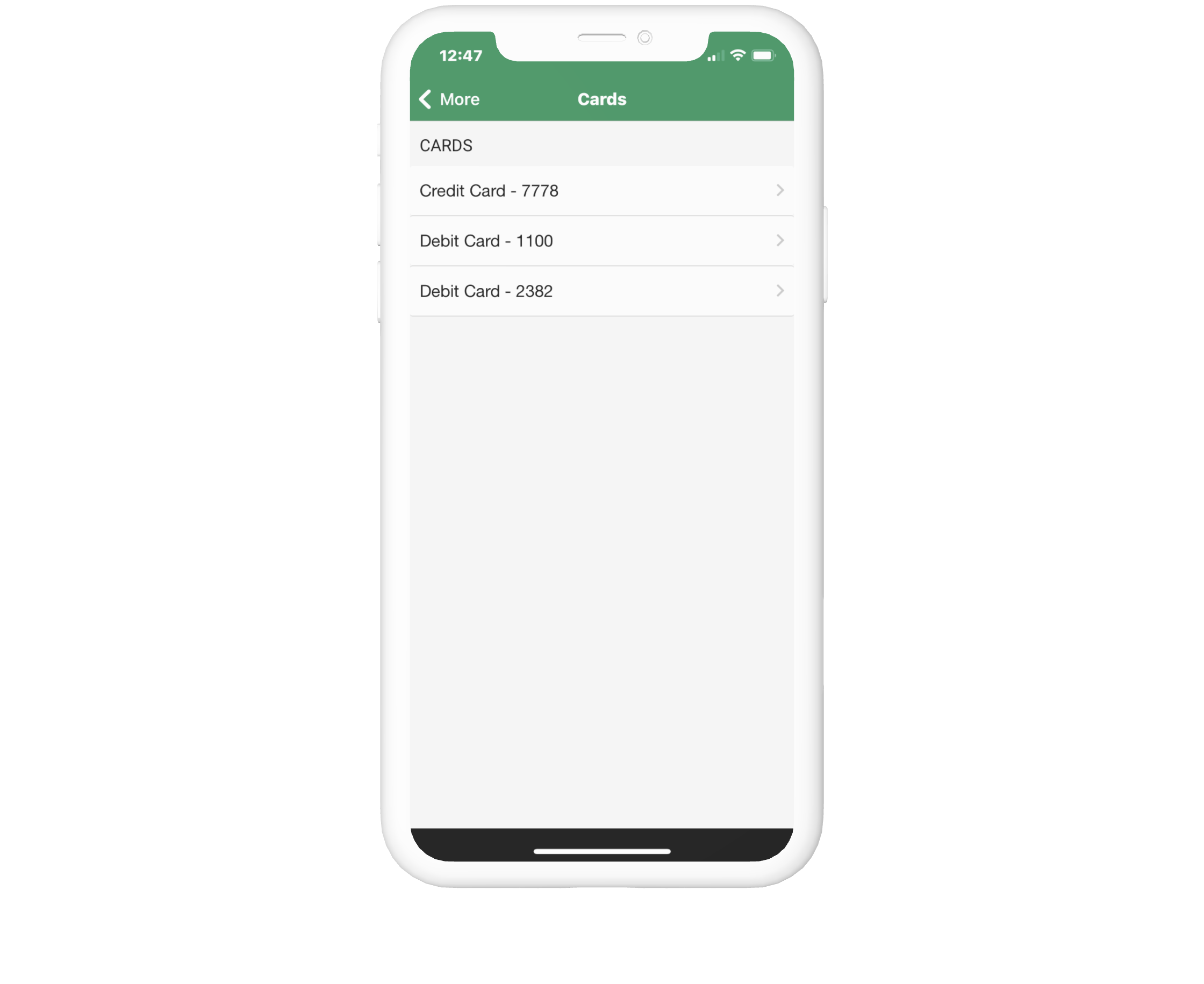

After clicking Card Controls from the More menu you will be presented with a screen with a list of your Credit and/or Debit Cards. You can manage card controls for each card by selecting a Credit Card or Debit Card from the screen. Changes you make take effect immediately for each card you've set controls for.

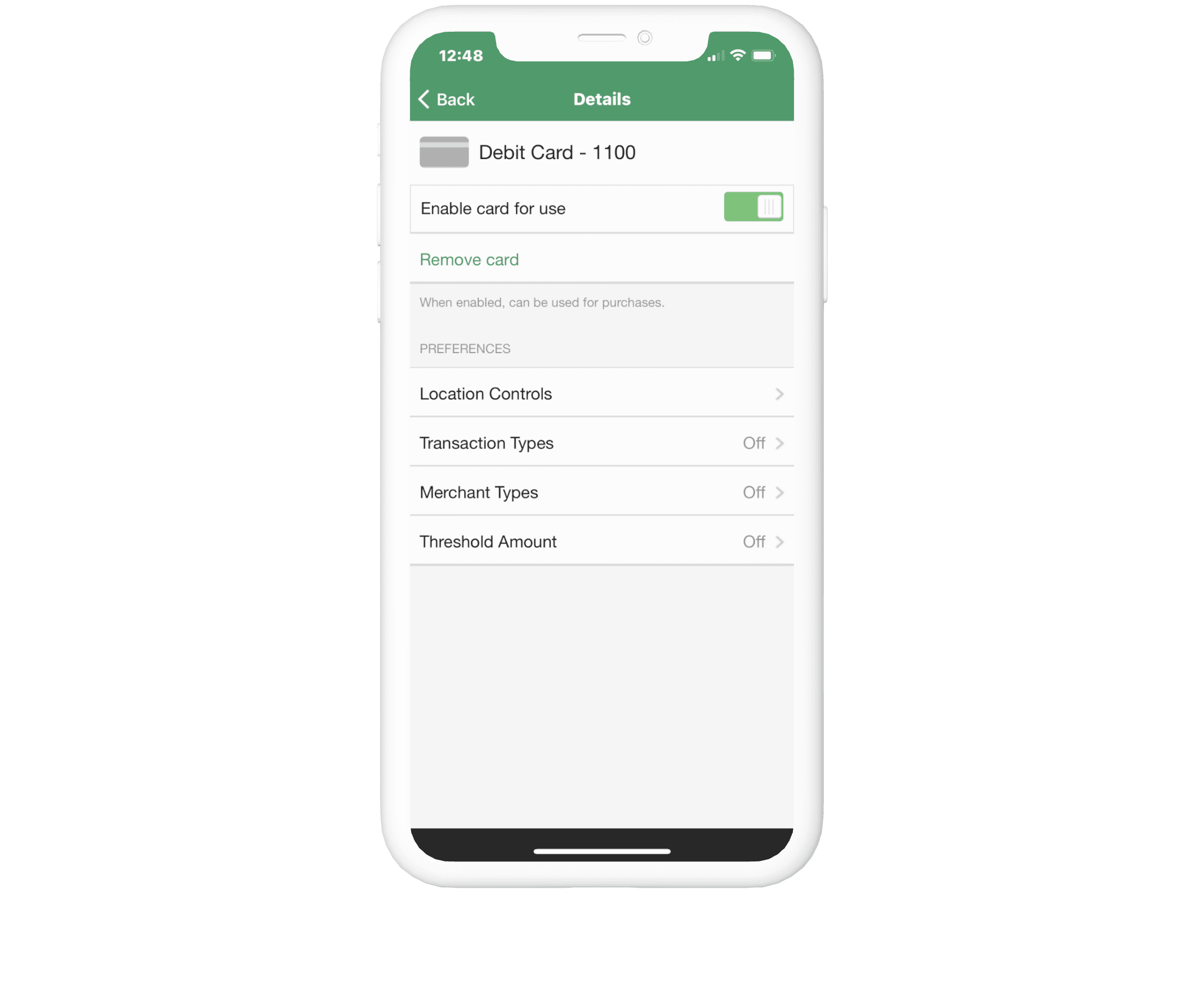

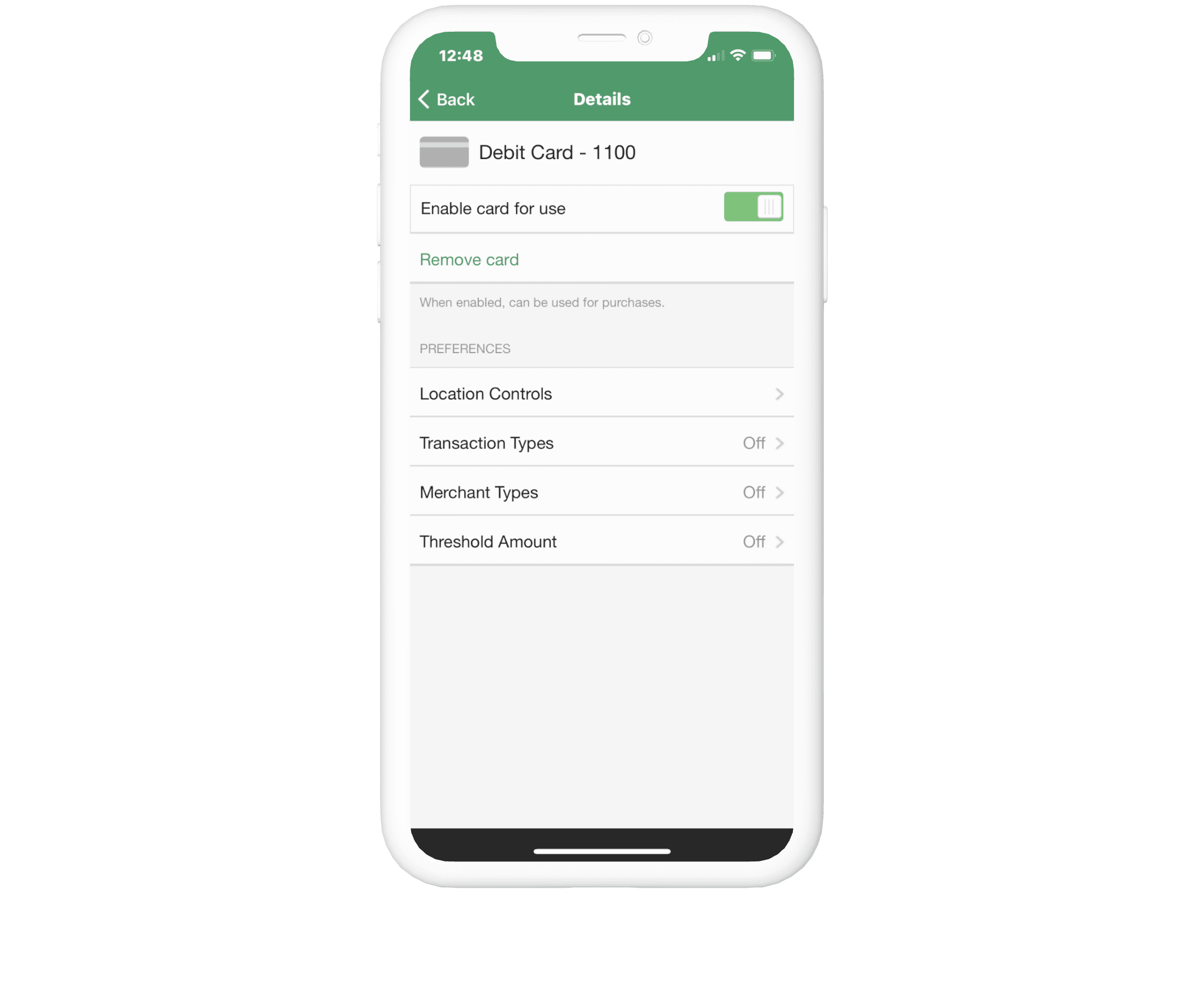

Card Control features are listed for each Credit or Debit Card. You can turn each card on or off by simply moving the toggle beside Enable card for use. When the toggle is green, your card is enabled. Move the toggle to the left and the button turns gray and you will disable your card.

- Get real-time activity alerts by merchant or transaction type.

- Control where your card can be used with Location Cotrols - Restrict card use to specific geographical regions, merchants, or transaction types.

- Set spend limits within your card’s approved transaction limits.

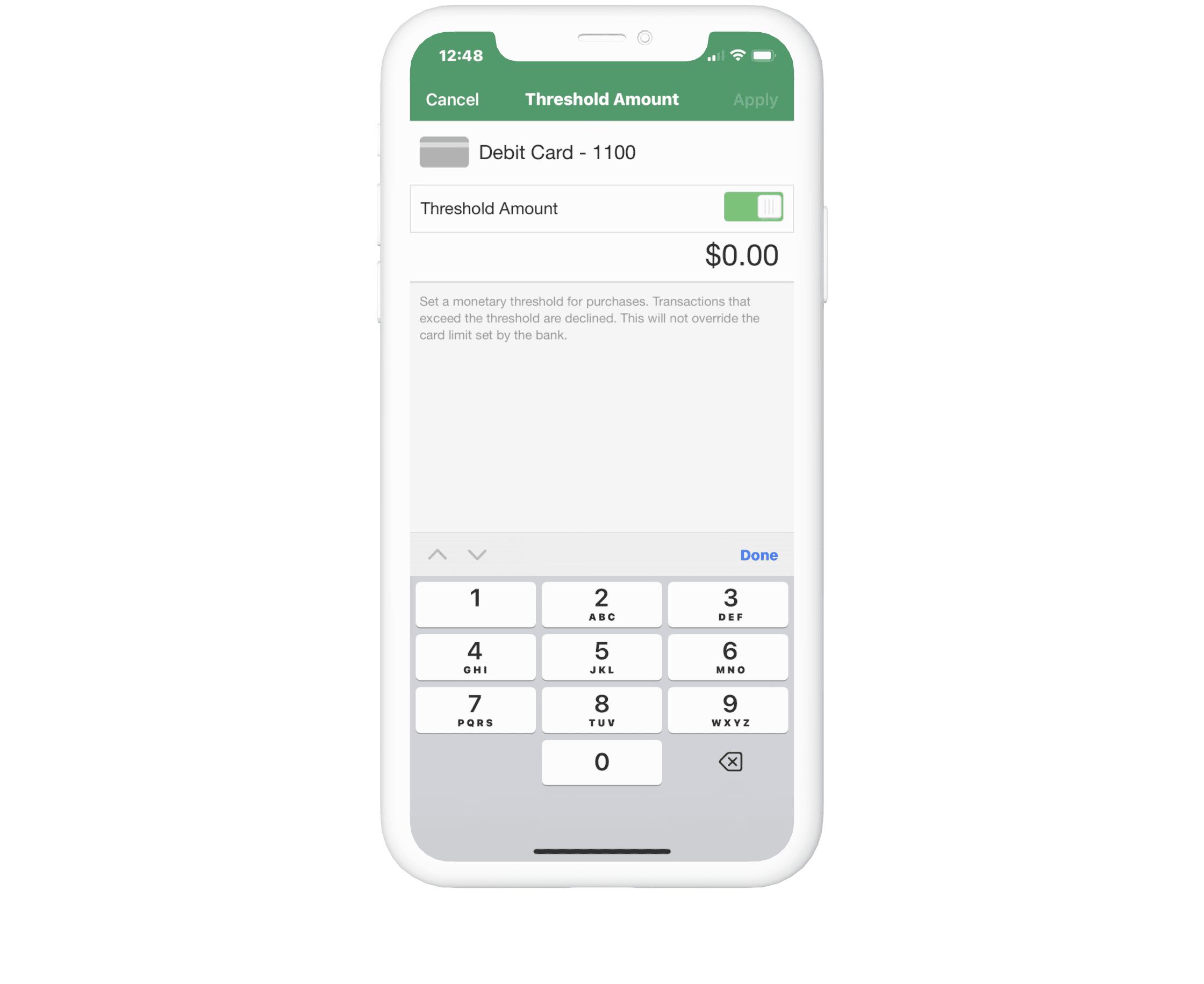

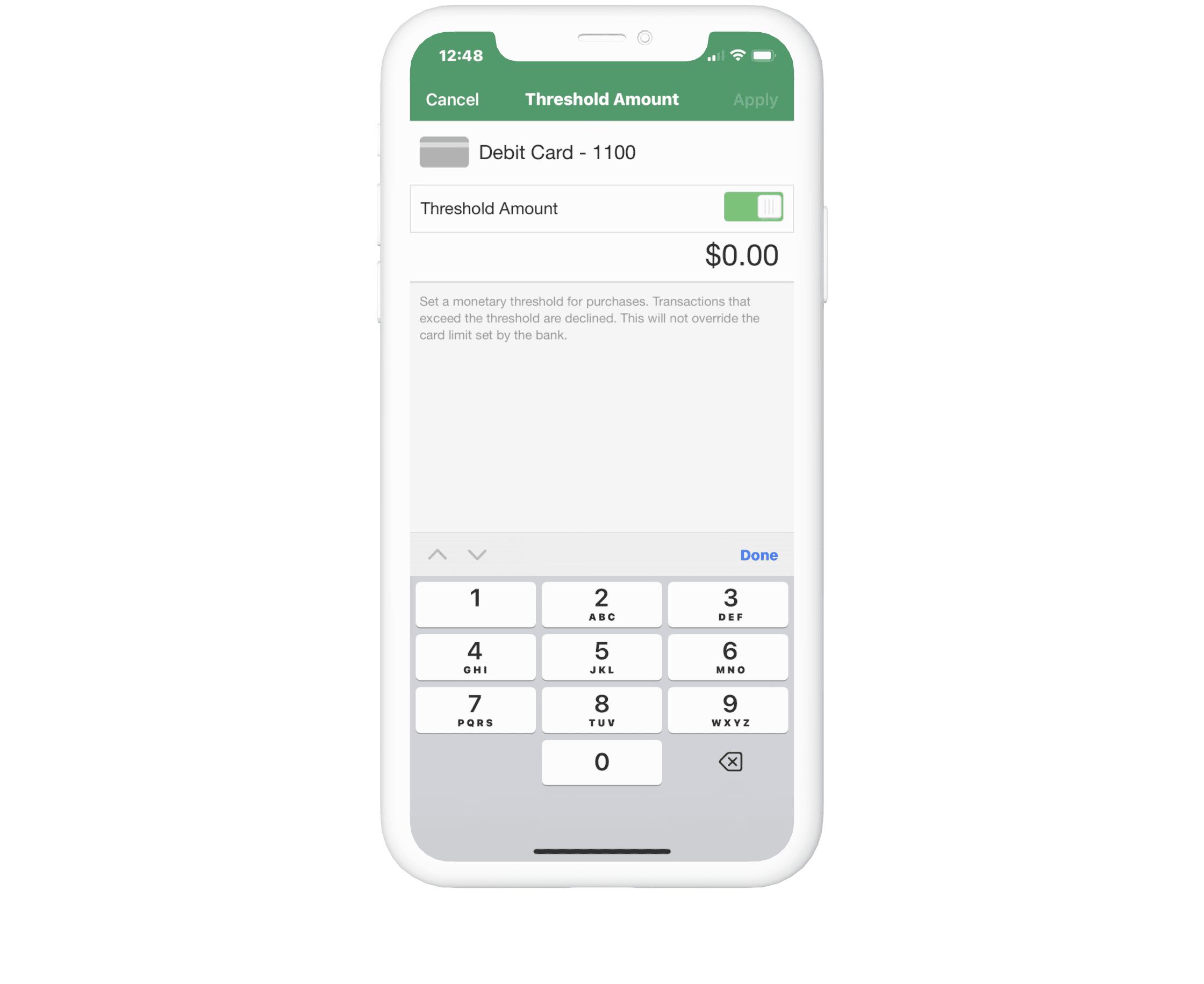

Stay vigilent to a budget and keep yourself safe from fraud by setting up spend threshhold amounts for each card Transactions that exceed the threshhold amount you set are declined. Be aware that this will not override daily limits set by the bank for each card. Transactions inlcude in-store, online and ATM.

Card Controls is easy to find within your Bank With United Mobile App. After logging in, click More at the bottom of your screen. Then select Card Controls from the menu, directly under Help. If you do not see Card Controls in your list of options, please update to the latest version of the United Bank Mobile App.

After clicking Card Controls from the More menu you will be presented with a screen with a list of your Credit and/or Debit Cards. You can manage card controls for each card by selecting a Credit Card or Debit Card from the screen. Changes you make take effect immediately for each card you've set controls for.

Card Control features are listed for each Credit or Debit Card. You can turn each card on or off by simply moving the toggle beside Enable card for use. When the toggle is green, your card is enabled. Move the toggle to the left and the button turns gray and you will disable your card.

- Get real-time activity alerts by merchant or transaction type.

- Control where your card can be used with Location Cotrols - Restrict card use to specific geographical regions, merchants, or transaction types.

- Set spend limits within your card’s approved transaction limits.

Stay vigilent to a budget and keep yourself safe from fraud by setting up spend threshhold amounts for each card Transactions that exceed the threshhold amount you set are declined. Be aware that this will not override daily limits set by the bank for each card. Transactions inlcude in-store, online and ATM.

- Container 1

- Container 2

- Container 3

- Container 4

Frequently Asked Questions

Card Controls are tools within the United Bank’s Mobile Banking App that allow you to manage when, where and how your debit and/or credit card is used, keeping your card safe and providing instant notifications whenever your card is used.

Card Controls are available for Consumer Credit and Debit Cards. As an exception, Business Debit Cards may have access to Card Controls if the owner/signer accesses accounts via the Consumer Bank With United Mobile Bank App.

Business Credit Cards are NOT supported at this time.

Log in to the Bank With United Mobile Banking App.

Select "More" and choose "Card Controls" (if you do not see this option, update to the latest version of the Bank With United Mobile Banking App).

Your debit and/or credit cards will appear.

Turn your debit or credit card on and off - ability to immediately disable your card to prevent all or certain transactions, including in-store, online, and ATM.

Set Push Notification Alerts for transactions - get real-time activity alerts by merchant or transaction type.

Location and Transaction Type Control - control where your card can be used - Restrict card use to specific geographical regions, merchants, or transaction types.

Threshold Amount - set spend limits within your card’s approved transaction limits.

Changes in Card Controls take place immediately so don’t worry if you think you’ve disabled something you need. You can change your settings at any time and it will take effect, instantly!

Verify that “allow notifications” is turned on within the settings of your phone, for the Bank With United Mobile Banking App.

Debit Cards: No, if you turn a feature on or off through Card Controls, it will only apply to your card.

Credit Cards: Yes. Joint Credit Cards share the same card number, therefore any changes in Card Controls will affect both cards.

Normally, your card settings will be updated immediately. However, Card Controls is reliant on computer and telecommunication systems. Disruptions to these systems may result in Card Control settings not being updated immediately from time to time. Make sure your device is connected using the Cellular Data or a Wi-Fi Network. Your settings will be updated as soon as the disruption is resolved.

If the transaction was unauthorized, you may dispute this by contacting United’s Customer Care Call Center or your local branch and follow the normal card dispute process.

No. The limits you have set by the bank on your cards will continue to be in place and this control will not override those daily limits.

Card alerts allow you to receive notifications of recent debit/credit card transactions. You can activate or deactivate card alerts, set card alerts for specific types of merchants and/or transaction types, and select a threshold transaction amount for receiving a card alert.

Some merchants (vending machines, kiosks, service providers, transportation providers, etc) process transactions in different locations, through alternate networks, or under a variety of different names. This may result in approval of some transactions even though your controls may have been intended to prevent them.

Amazon Marketplace is a good example since there are a variety of different merchant types processing in a variety of locations. (Amazon is its own merchant, as opposed to various different merchants processing under Amazon Marketplace).

Online Banking alerts are text message alerts set up within online banking for various transaction or service alerts. Card Control alerts are specific to debit or credit card transactions. It is possible if alerts are set up in both places to receive duplicate alerts.

Online Banking alerts come as a text message. Card Controls push notifications come as a small pop-up message that is “pushed” to the user’s mobile device via an installed mobile app. (see above)

For debit card inquiries call : 800.327.9862

For credit card inquiries call: 800.242.7600