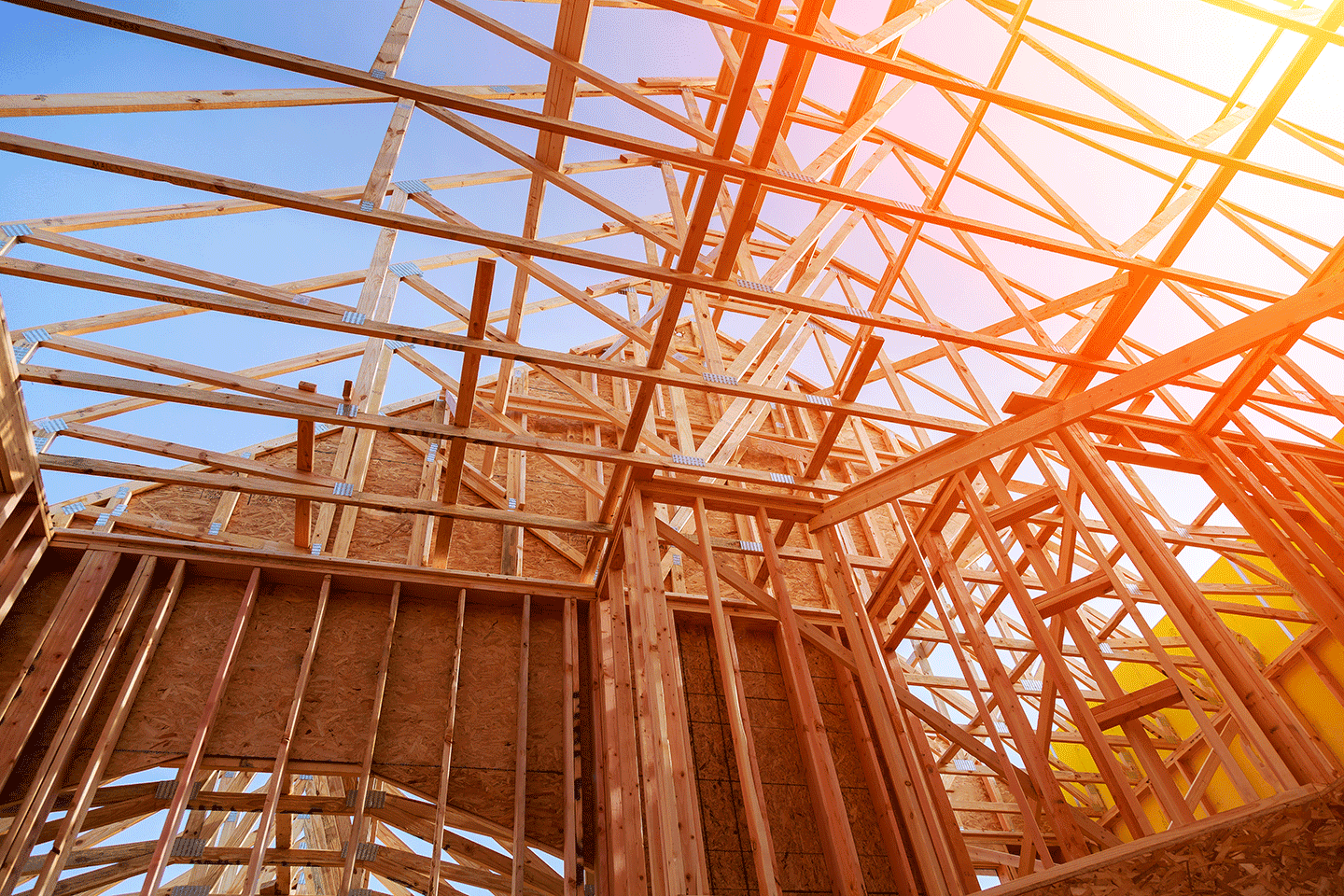

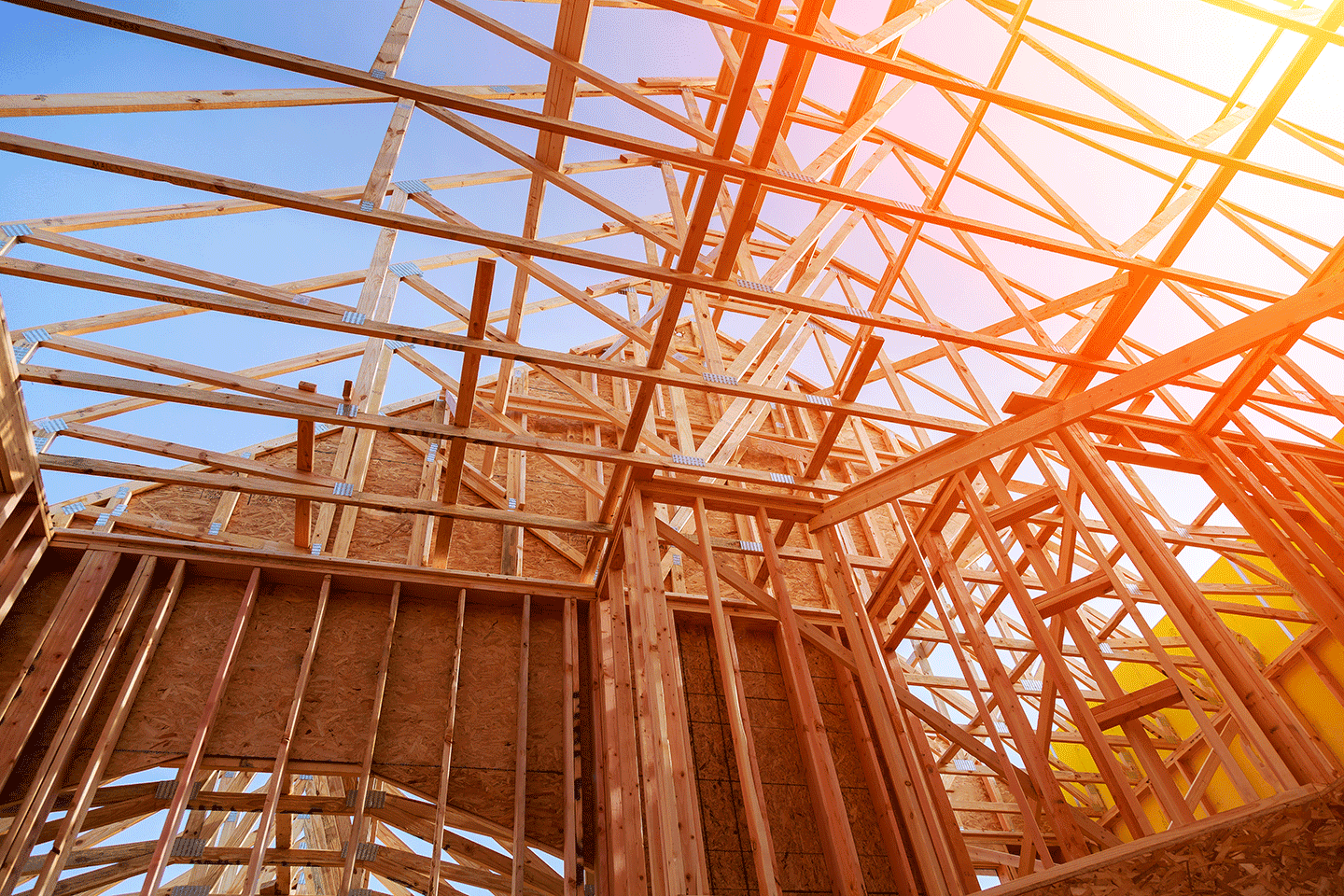

Our extensive knowledge of the new construction loan market, allows us to offer a wide range of products, competitive pricing and streamlined loan processing. Whether you are interested in new construction, custom home, renovations or a complete tear-down, we welcome the opportunity to discuss your project in detail.

LOAN OPTIONS

A Mortgage Built Just for You

LOAN OPTIONS

A Mortgage Built Just for You

New Construction Home Loans

Contact your Mortgage Loan Officer today for more information. We will work closely with you and your contractor/builder to design a flexible and sensible draw schedule. In-house underwriting, local loan administration, and an experienced team help to ensure a smooth mortgage financing process every step of the way.