You’ve done all the retirement planning you can. You’ve saved, you’re in a good place, and then an unexpected expense strikes. How do you handle it? Have you budgeted for a retirement emergency fund?

Retirement Budgeting When Circumstances Change

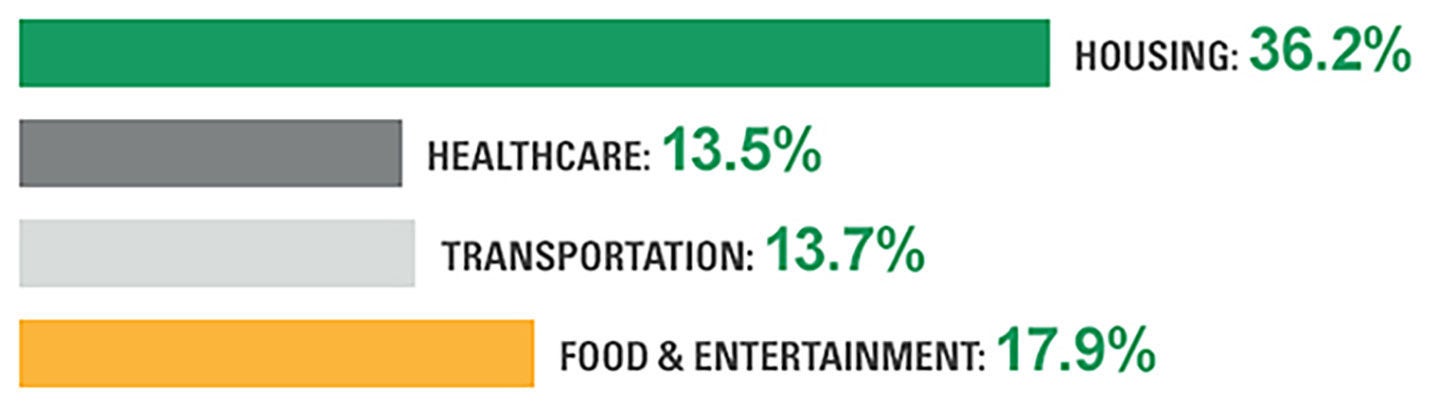

Average Costs for Retirees (65 & older)¹

By percentage of average retirement annual expenses

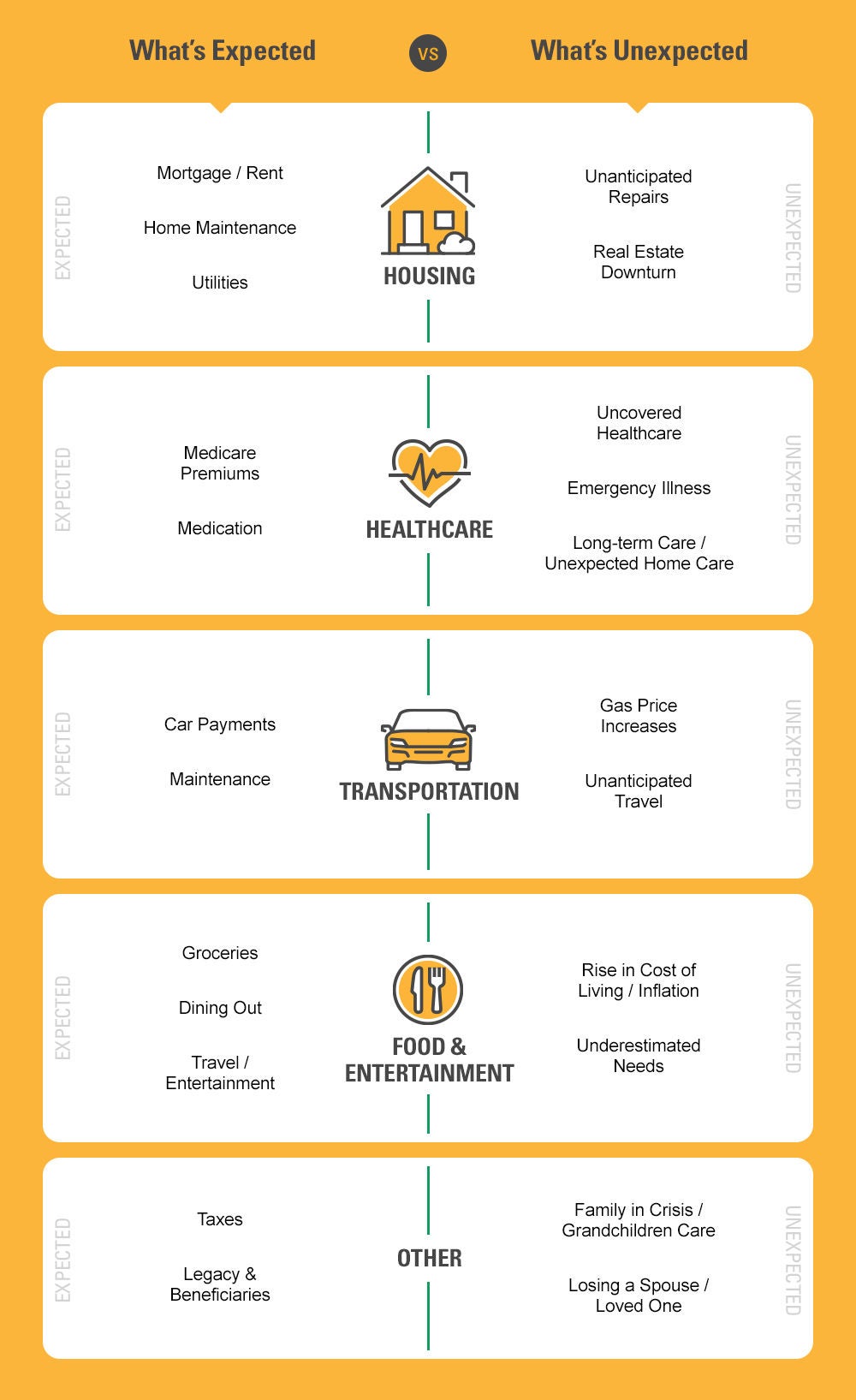

Budgeting for unexpected expenses in retirement is crucial.

Budgeting for unexpected expenses in retirement is crucial.

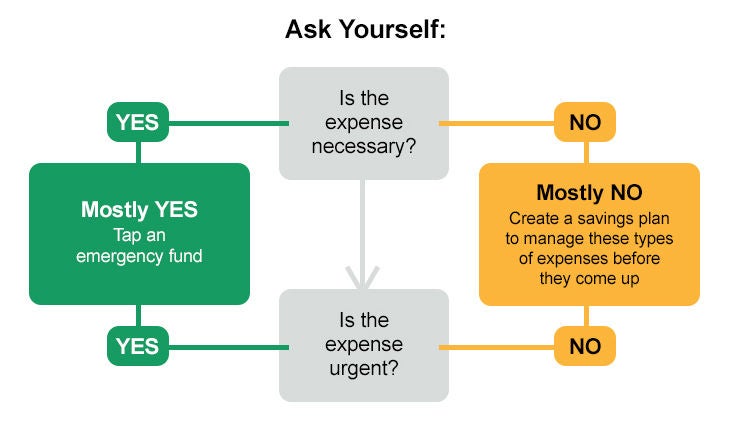

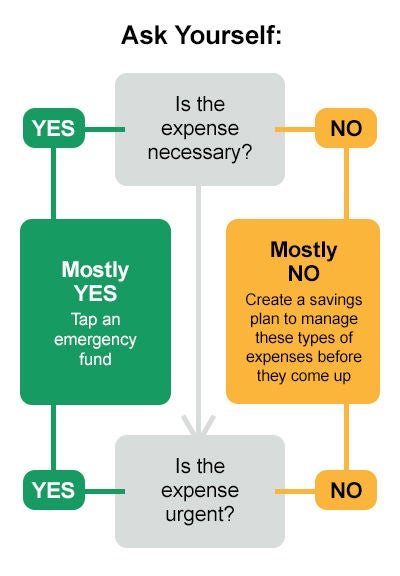

What do you do when you're hit with an unexpected expense?

Stay One Step Ahead

- Plan for potential emergencies by saving for them.

- Be aware of the tax implications of unplanned withdrawals.

- Continuously evaluate your retirement withdrawal strategy.

For personalized planning, find a Financial Advisor at United Bank in your area.