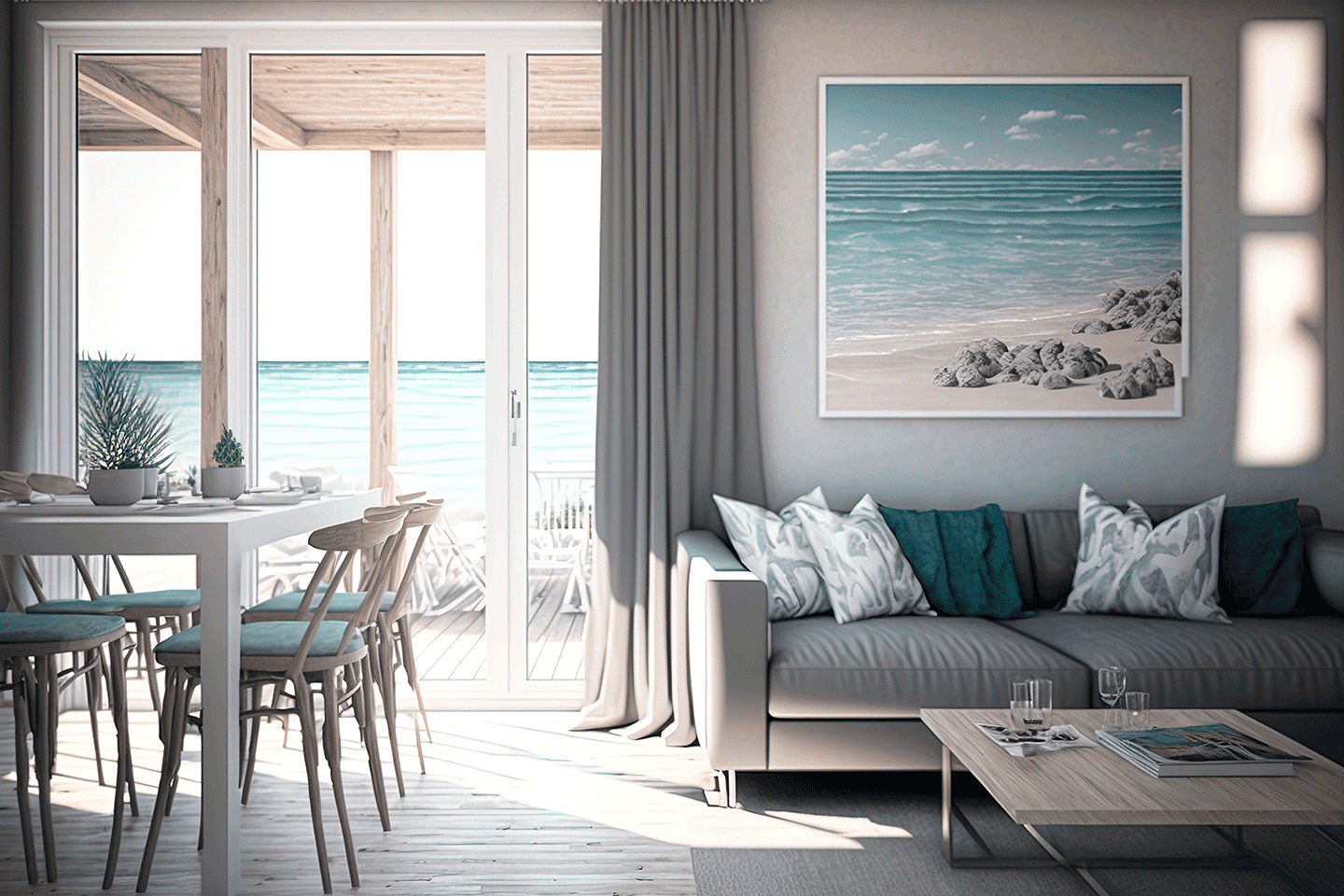

Have you been toying with the idea of purchasing a second home? Maybe you have been thinking about retirement or purchasing an investment property to generate income. Perhaps you are considering a vacation home to enjoy with your family on weekends and holidays. At United Bank we are pleased to extend several mortgage options for investment property financing.

Below are some important factors to consider: