Manage Your Money, Your Way.

Easily access all of your United Bank personal accounts 24 hours a day. Check balances, transfer funds, review transaction history, place stop payments, order checks, and much more—anytime and from anywhere.

Easily access all of your United Bank personal accounts 24 hours a day. Check balances, transfer funds, review transaction history, place stop payments, order checks, and much more—anytime and from anywhere.

Easily access all of your United Bank personal accounts 24 hours a day. Check balances, transfer funds, review transaction history, place stop payments, order checks, and much more—anytime and from anywhere.

Easily manage your finances by checking balances, viewing statements, paying bills, transferring money, and setting up alerts. Customize your view to see your daily activities any way you want. And arrange your Accounts Overview to make it work for you. Choose your view at each login to suit your needs for the day.

With your most-used tools right at your fingertips on the Accounts Overview Page, there's no need to go searching.

We've simplified transferring funds between your United Bank accounts or to other accounts with quick access directly from your Accounts Overview screen. You can make one-time transfers or set up recurring transfers whenever, wherever you see fit. A new streamlined Bill Pay has a simplified view and search of common payees to speed up your time paying bills.

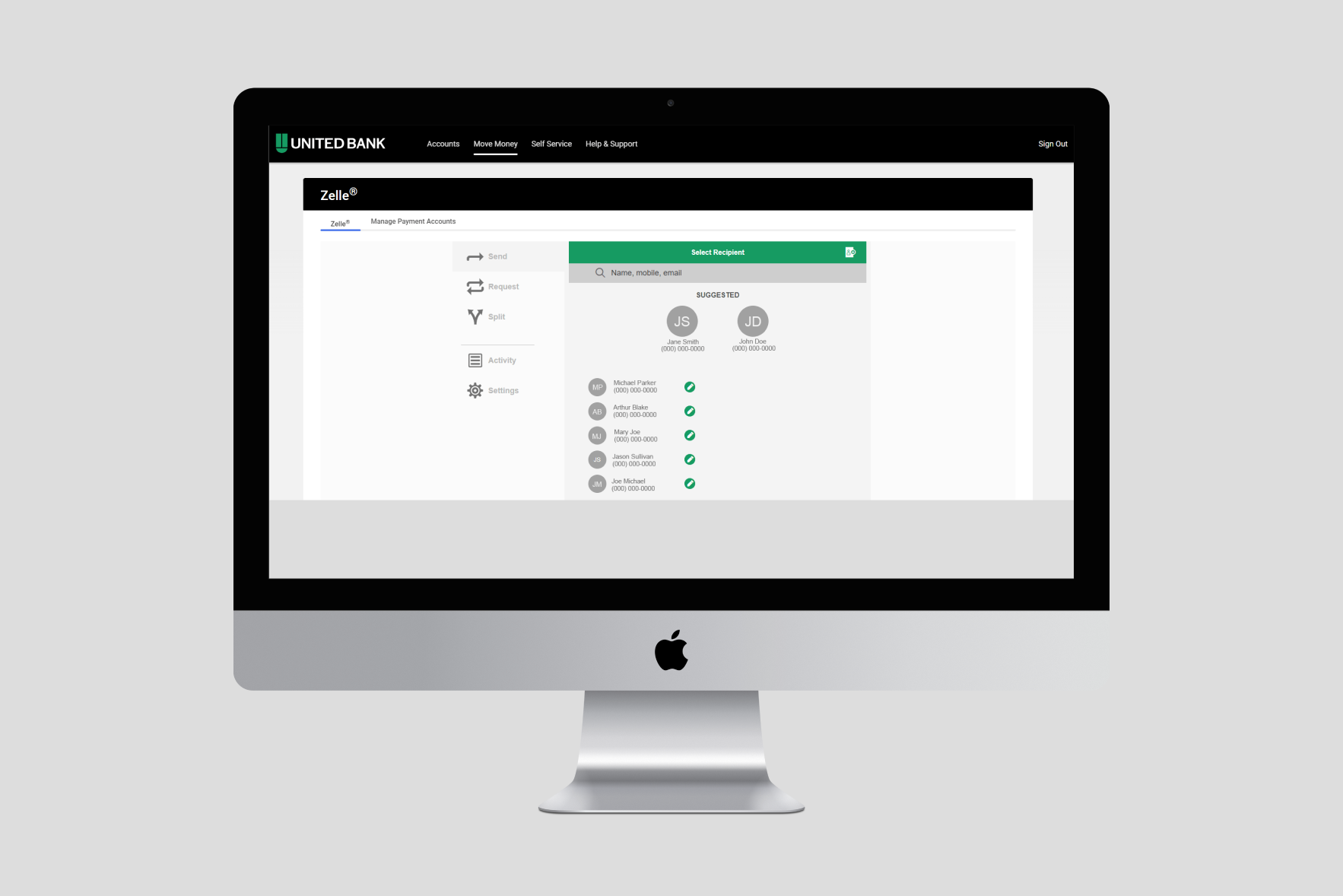

Zelle® is also now available in our online banking platform to help you send money quickly and easily to family and friends. You can conveniently access Zelle from our Bank With United mobile banking app and now from your computer directly in online banking.

We've simplified transferring funds between your United Bank accounts or to other accounts with quick access directly from your Accounts Overview screen. You can make one-time transfers or set up recurring transfers whenever, wherever you see fit. A new streamlined Bill Pay has a simplified view and search of common payees to speed up your time paying bills.

Zelle® is also now available in our online banking platform to help you send money quickly and easily to family and friends. You can conveniently access Zelle from our Bank With United mobile banking app and now from your computer directly in online banking.

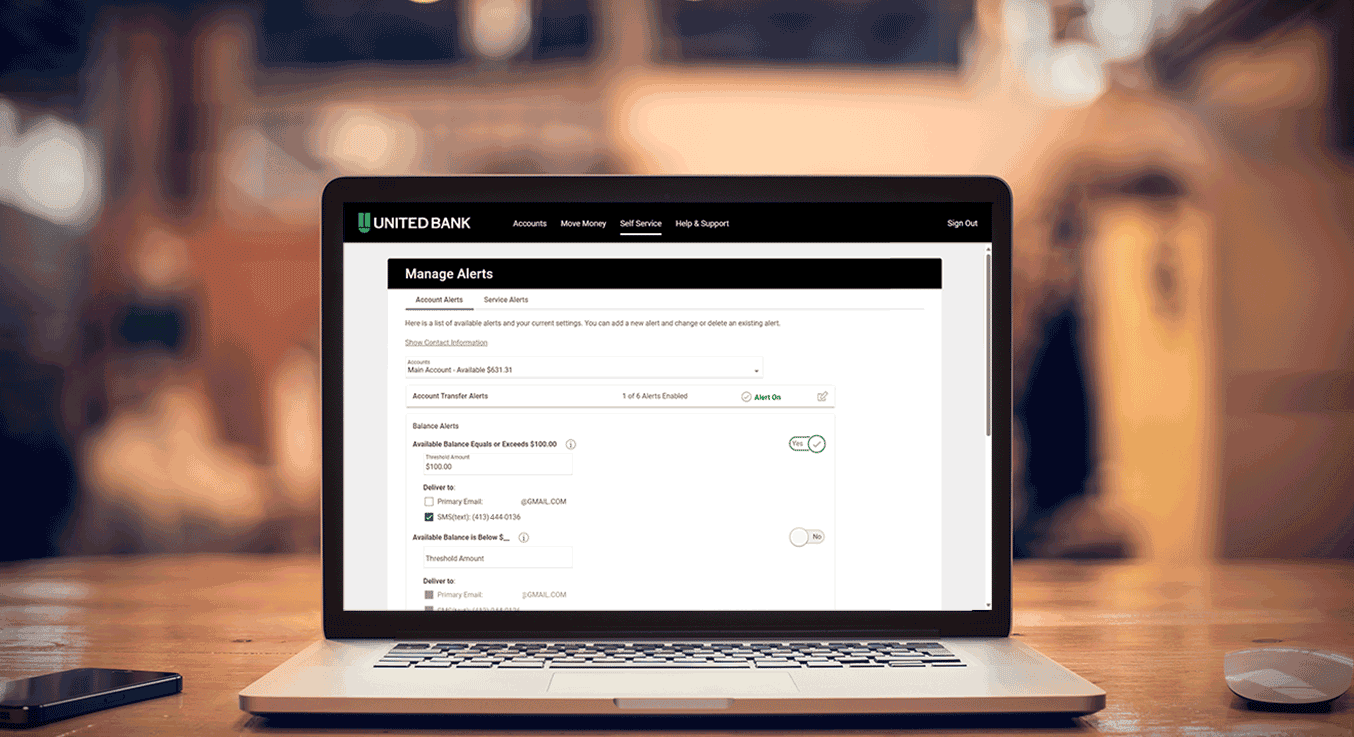

Stay in control of your finances and banking activity with custom alerts. Easily set up notifications for balance changes, transfers, and service alerts.

Manage your money effortlessly with personalized reminders, allowing you to focus on your daily responsibilities.

Your security is our priority. We safeguard and protect your money with fraud monitoring and secure sign-in. Multi-factor authentication will continue to be available to ensure identity verification. To learn more about the ways that you can avoid and prevent fraud, visit our security center.

Add United Bank’s Personal Finance tool to your online banking or mobile experience to get a complete picture of your finances and stay on track with your goals.

If you are already an active user of Personal Finance, your access will not change.

If you forget your password, you can click the “Forgot Username or Password” link under the Sign In button from the Secure Sign-In box to unlock your account or reset your password. You then must complete the following steps:

Or, you can simply call one of our customer service representatives at 1.800.327.9862.

The full account number is available at the top of your statements which can be viewed in a PDF. This can be found by navigating to the Accounts Tab and selecting the Statements & Documents link. Under Statements, select any statement to view. If you receive statements via mail your account number can be found at the top of the statement.

First, you need to have a user ID and password. If you did not set up Bill Pay when you first opened your Online Banking access, you will need to register your account by accepting the terms and conditions for Bill Pay. Then you can begin by simply adding payees.

There are two kinds of bill payments: A one-time payment is processed on the day you specify. On that date, the funds are withdrawn from your account and the payment is sent to the merchant/payee. The merchant/payee receives the payment two to five days after the payment date. A recurring payment occurs automatically at your specified frequency, for as many times as you indicate.

Payments can be set up as much as 12 months in advance.

If your payment was made to the merchant/payee by check, you can determine if the check has been cashed by viewing the payment details in your payment history. Actual verification needs to come from the merchant/payee. If the payment was made via electronic remittance, then you must contact the merchant/payee to verify that the payment was received and posted. You can also set up an automatic alert to notify you by email or SMS text.

The Loan account number for external bill payments will need to be formatted with the 5 digit note number followed by a 0, then the 11-digit account # (include leading zeros if needed) – EXAMPLE: Account # 1234567 Note # 02021 = 02021000001234567

Yes, you may submit a Service Request to update your address. Navigate to the Help & Support tab and select the Service Requests Link. Select Change of Address, fill out all form fields, and choose Continue. Confirm that all the information is correct and choose send. Allow up to two business days for the change to take effect.

Yes, you will use eZCard to access your credit card history. Look for the link to eZCard displayed under your credit card account information.

We recommend downloading reports one at a time. This will allow you to choose from the following download formats: Excel, Text, QuickBooks, or Quicken.

Transfer history is available by navigating to the Move Money tab and select Transfer link. Select History to view transfer history.