Rossitsa (Rossi) Getskova is a Vice President and Portfolio Manager at United Wealth Management. She joined United Wealth Management in 2005 and served as Head of Equity Research before becoming a Portfolio Manager. Rossi earned her BS and MBA from the University of Charleston with an emphasis in business and finance. Rossi holds the Series 7 and 66 securities licenses.

An active member of the community, Rossi is the Investment Committee Chair for the WV Bankers Association, serves on the West Virginia Independent Colleges & Universities board of directors, and is a member of the University of Charleston Financial Planning Advisory Committee. She is also a member of the Investment Committee for the YWCA and a former member of the Board of Directors of the Charleston Ballet.

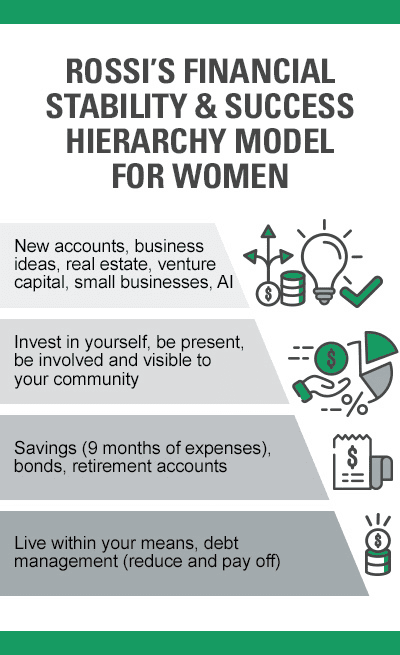

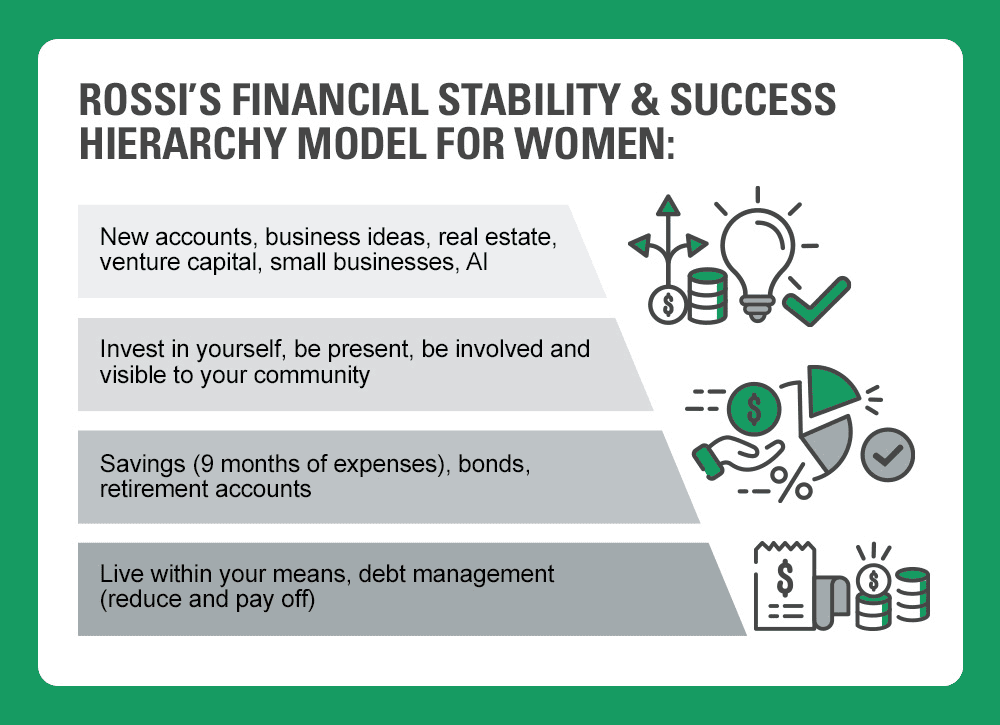

The Thrive team spoke to Rossi about her expert perspective and guidance on how women can best approach and navigate investing in 2024.