Budgets – create a budget and stick to it. Before you start using BNPL credit, decide how much money you can afford to spend on BNPL payments each month and avoid spending beyond that. For more budgeting tips, check out all of our resources on Saving & Budgeting and our easy to use Calculators for both tactics.

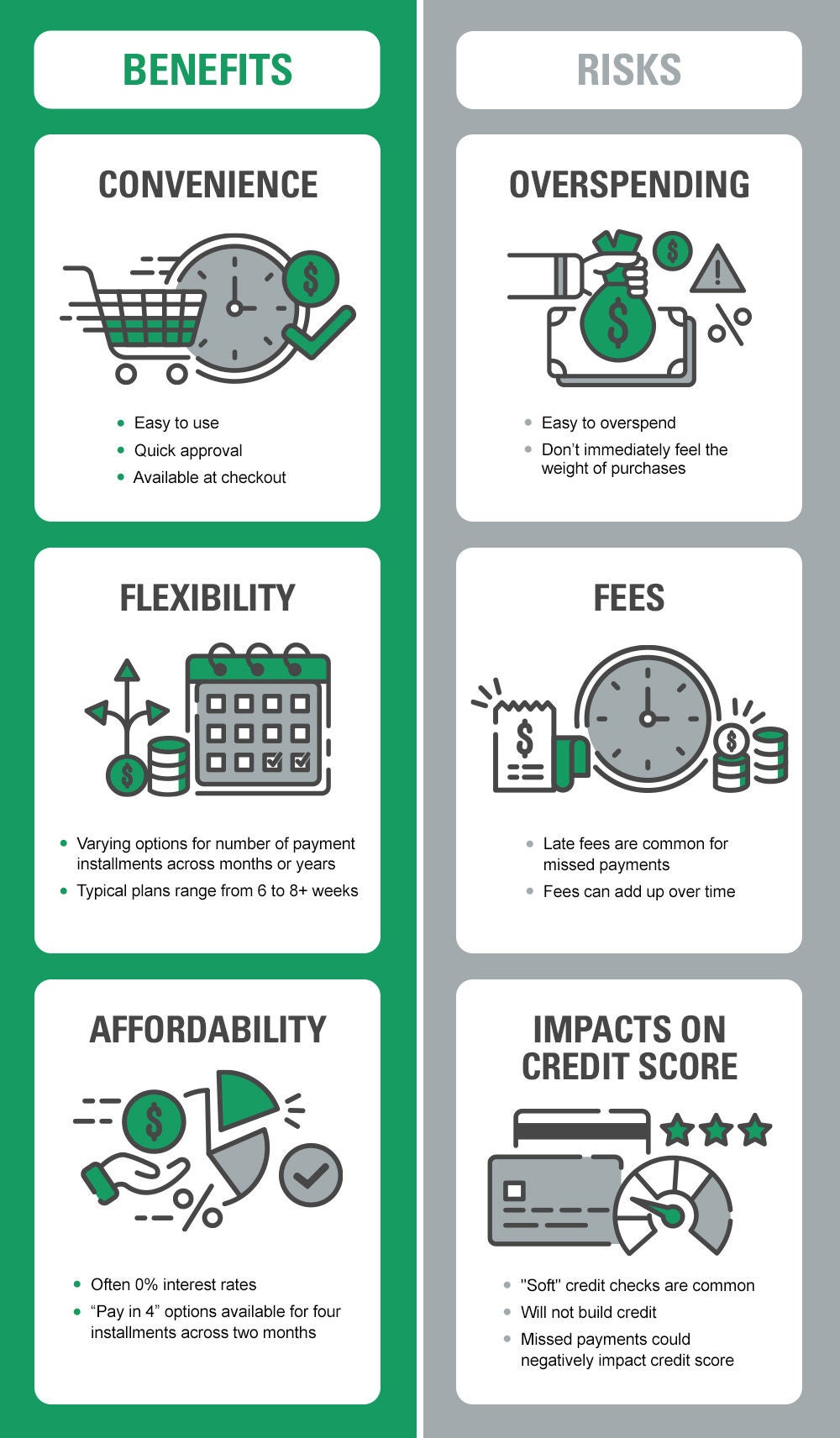

Avoiding fees - with BNPL, it is immensely important to remember to make your payments on time. Make sure to set up reminders so that you avoid any late fees from a missed payment. Fees can add up quickly and easily negate the benefits of using BNPL.

Payment schedule – with BNPL it is important to remember that while flexible, BNPL typically operates on a very different schedule that credit card payments. BNPL can require payments on a bi-weekly basis, so keep in mind that you will likely be making a payment more frequently than you would your typical credit card payment.

BNPL is just one form of credit. The more you know about credit, the better equipped you will be to use it wisely.

For more on the basics of credit, check out our Credit Overview or speak directly to a United Bank representative today. Contact us.