United’s corporate governance is thoroughly outlined in our proxy. The proxy discusses in detail the Board, their role, and their committees. These pages are not an outline of comprehensive corporate oversight, but rather, supplemental details on how United manages select ESG-related program areas.

Governance

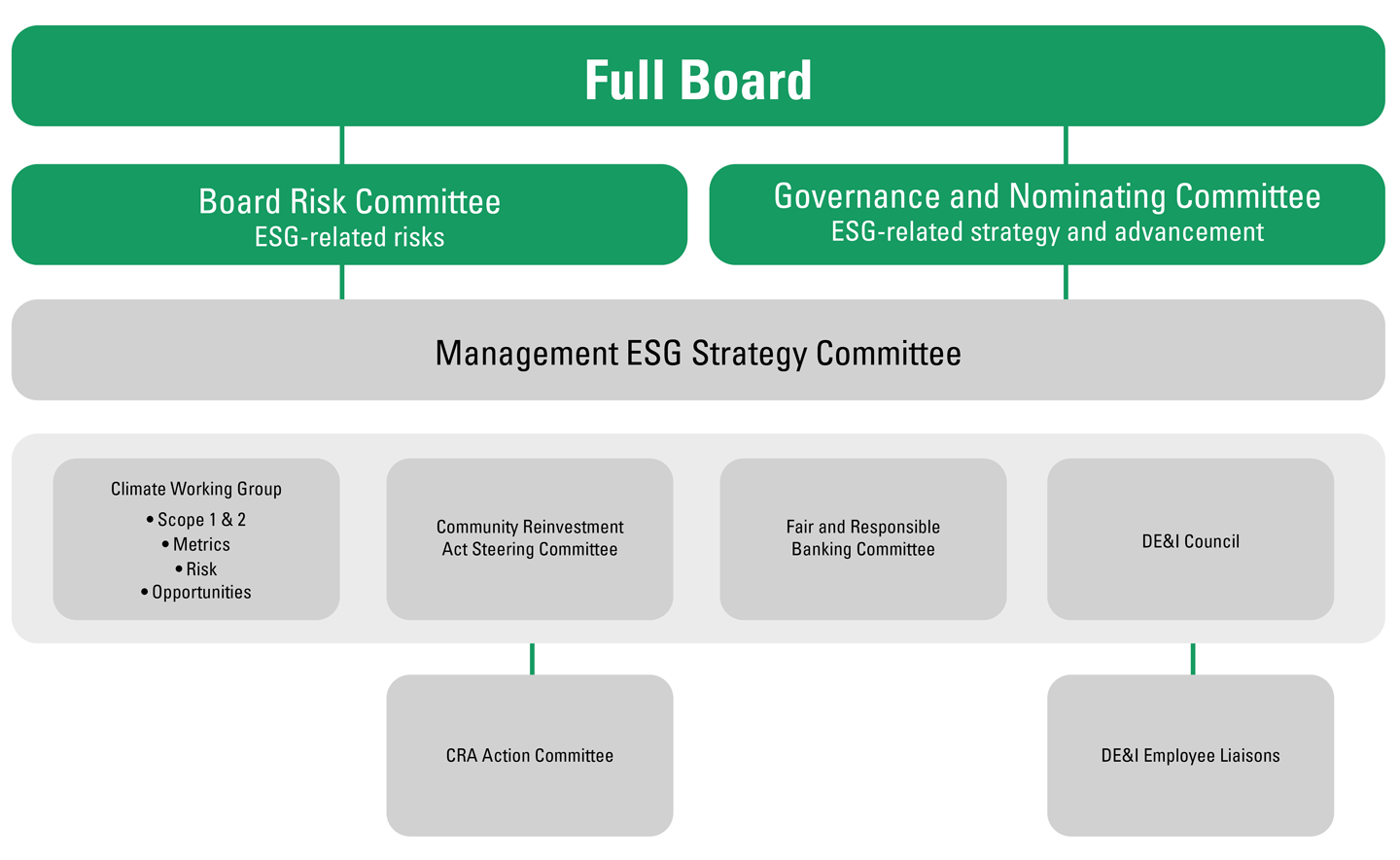

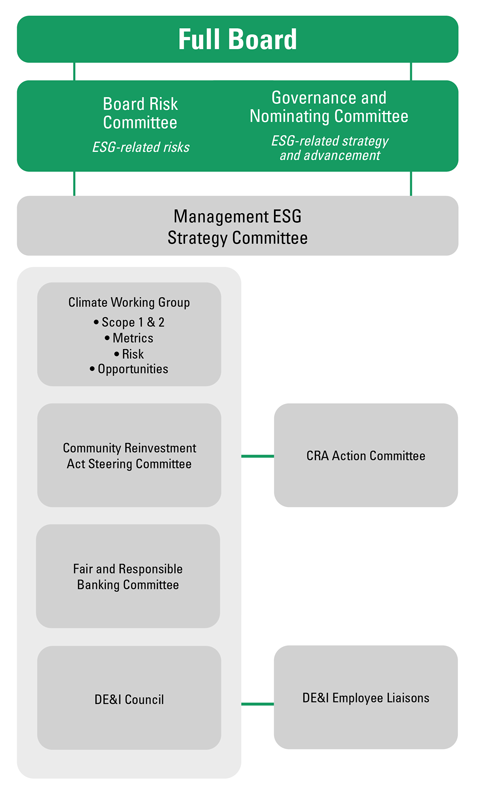

ESG Oversight

United’s ESG Management Committee includes the CEO, CFO, UBSI President, CRO, UBSI COO, and Chief Credit Officer. They meet regularly to set strategy, priorities, and pace of program advancement. United is enhancing its ESG program through expanding disclosures across ESG pillars, sustaining our strong community commitment, and providing a variety of training opportunities at various levels of the company on ESG-related areas.

United’s ESG Management Committee includes the CEO, CFO, UBSI President, CRO, UBSI COO, and Chief Credit Officer. They meet regularly to set strategy, priorities, and pace of program advancement. United is enhancing its ESG program through expanding disclosures across ESG pillars, sustaining our strong community commitment, and providing a variety of training opportunities at various levels of the company on ESG-related areas.

Stakeholder Engagement

We are committed to increasing transparency, and we engage with stakeholders through a wide variety of mediums, summarized below.

Stakeholder | Engagement Tools |

Shareholders |

|

Customers |

|

Employees |

|

Communities |

|

Ethics and Integrity

The UBSI Code of Business Conduct and Ethics is approved annually by the Board of Directors and is available here. The Board of Directors determines or appoints a designee to take appropriate action in the event of a code violation. The Code outlines that United employees, management, and Directors must comply with the Federal Bank Bribery Statute, which makes it a crime to seek or accept gifts, or anything of value, from any person with the intention to influence or reward the employee in connection with the business transaction. It also includes “Special Ethics Rules for Principal Executive Officers” in compliance with Sarbanes–Oxley Section 406. This SOX control is tested annually by United’s Internal Audit. In addition, Internal Audit reviews all operations at least once every three years, based on the assessed risk. Some of these audits, such as Corporate Governance, would include elements of business ethics and anti-corruption.

United also maintains a whistleblower policy and an anonymous “hotline” in the form of a website submission form. All items reported through the Company’s whistleblower website or reported directly to the Corporate Auditor are researched and followed through to resolution by Internal Audit, or in the case of employee fraud or losses, by Risk Management. All items are reported to the Audit and Risk Committees of the Board.

United is committed to the highest possible standards of openness, integrity, and accountability. In line with that commitment, we encourage employees and others with serious concerns about any aspect of the Company’s work to come forward and voice those concerns without fear of reprisals. The policy outlines that United will do its best to protect the identity of whistleblowers when they do not want their name to be disclosed.1 United will not tolerate harassment or victimization of those who report a concern and will do what it lawfully can to protect those employees who act in good faith.

All full-time, part-time, and temporary employees are assigned the Code of Business Conduct and Ethics policy and employee handbook – which includes an outline of ethics, anti-bribery, and whistleblower procedures -- for review upon hire and with major updates. Employees must certify that they have read these documents.

Government Relations and Public Policy

United supports and participates in various industry trade associations, including support of lobbying efforts on behalf of the banking industry. Currently, we are members of the Consumer Bankers Association, American Bankers Association, Bank Policy Institute, Mid-sized Bankers Coalition, and Risk Management Association.

Additionally, United has an internal Government Relations Committee, which attends the annual American Bankers Association (ABA) Government Relations Summit, State Banker Days, and regular legislative events to stay informed and meet face-to-face with our respective state and federal representatives. We participate in calls to action, grassroots leadership, and offer financial support to BankPAC.

Risk Management

United views effective risk management as identifying the nature, likelihood, and magnitude of risk, then determining which risks to accept, reject, or mitigate in order to find the optimal balance between risk and reward.