- No minimum balance and no monthly maintenance fee

- Easy-to-open checking that's simple to manage

- Great choice for students, recent grads and young professionals

Free Checking that's full of features—not rules

Perfect if you're just starting out or just want a fresh (and free) start.

Free and easy checking is the right place to start

Super-convenient tools. Still free.

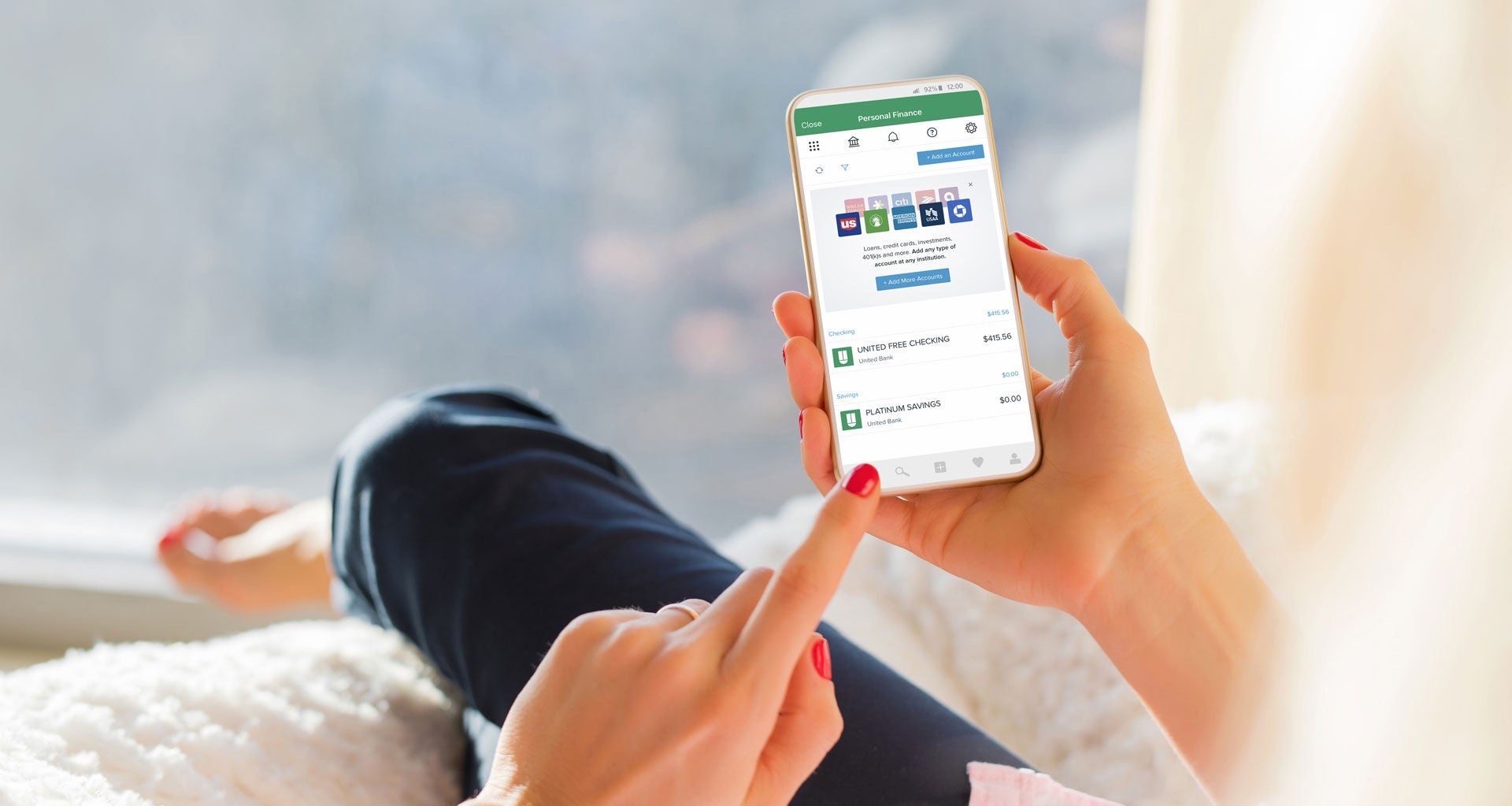

- Free Mobile and Online Banking plus free Bill Pay

- Free United Visa® Debit Card

- Free Personal Finance Tool to help budget and manage finances

Tech tools. Also free.

- eStatements and Mobile Banking with Check Deposits

- Friend-to-friend payments with Zelle®

- Apple Pay®, Google Pay® and Samsung PayTM

Open a free checking account

Here's all you need:

(Must be at least 18 years old.)